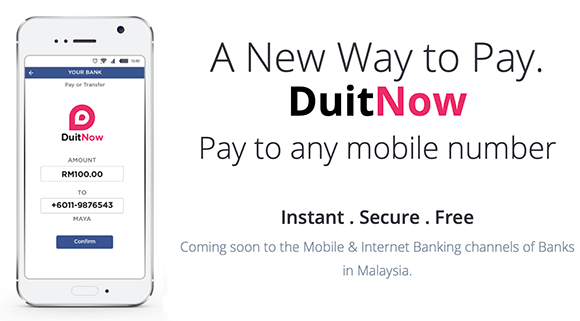

Usually, when it comes to fund transfers, you’ll need the person’s name, bank and the actual account number. These numbers can get really long and they are hard to remember. Soon, there’s an easier way to send money to any bank account in Malaysia and all you would need is the person’s mobile number.

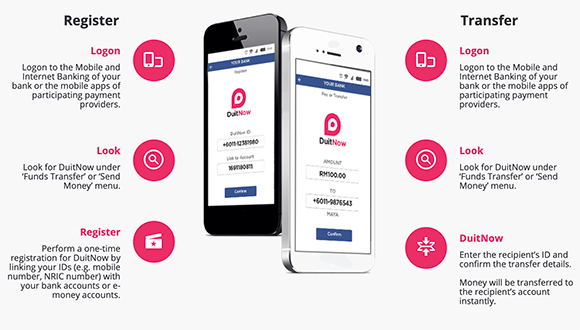

DuitNow is an interbank fund transfer service that’s introduced by PayNet, the network that handles MEPS, FPX and Interbank GIRO (IBG). To simplify fund transfers, DuitNow will use your personal ID which could be your mobile, NRIC or passport number as a substitute to your bank account. For businesses that are registered under SSM (Suruhanjaya Syarikat Malaysia), your business registration number can be used as well.

To get started, your mobile number must be registered first and your DuitNow ID can only be linked to a single bank account at any one time. If you have multiple mobile numbers, it is possible to register for multiple DuitNow ID as long as it can be verified by your bank. DuitNow isn’t limited to Malaysians as foreigners can register using their passport or international mobile number.

It’s worth pointing out that you only need to register for DuitNow to receive money. Those who are not registered are still able to send money to mobile numbers that are DuitNow enabled. As an added verification, the registered account holder’s name will be displayed before you can complete the transaction. This is a safety net just in case you’ve keyed-in the wrong number.

The fund transfer is done instantly in real time and it’s free of charge for transfers up to RM5,000. A 50 sen fee may apply for transactions above RM5,000. Apart from one-time transfers, DuitNow also supports scheduled and recurring transfers, and you can also add a DuitNow ID as your favourite recipient with your online banking facility.

DuitNow transfers are limited up to RM100,000 per day for consumers and up to RM100,000,000 per day for businesses. The actual transfer limit is also depended on your bank. According to DuitNow’s website, this feature will be available on internet and mobile banking apps of 44 banks in Malaysia as well as participating e-money mobile apps.

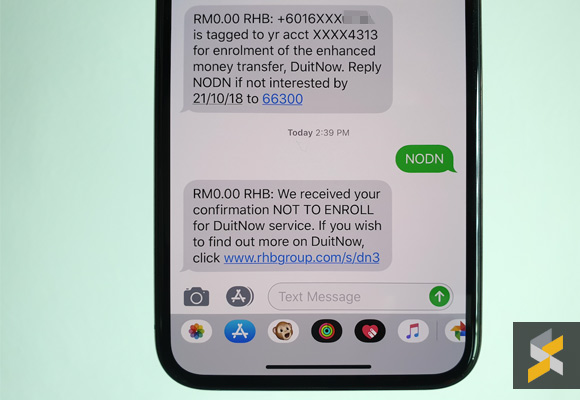

At the time of writing, it appears that some banks have started pre-registration and you might receive an SMS like the one sent below. The problem is this step is that usually a person might have multiple savings or current accounts with different banks.

Since you’re only allowed to link one bank account to your mobile number, your non-preferred bank account for receiving funds might be pre-registered automatically. If you don’t agree to the pre-registration, you can deactivate it before the given expiry date. After that, you will be able to manage your DuitNow ID on the respective bank channels once the service has gone live.

According to HongLeong Bank, DuitNow will be launched in December 2018. Before that happens, all customers are urged to update their mobile numbers with their respective bank. You can learn more on DuitNow’s website.