The growth of eWallets has been particularly noticeable in recent years, as our nation moves towards a cashless society. During Budget 2020, the government outlined plans to move towards a cashless nation with initiatives that will push the adoption of eWallets in Malaysia.

But with the vast amount of options out there to begin with, how does one even begin to make head or tail of which eWallet to use? It really depends. Certain eWallets sit within an ecosystem with other services that you might want to use, while others offer a more versatile reward system.

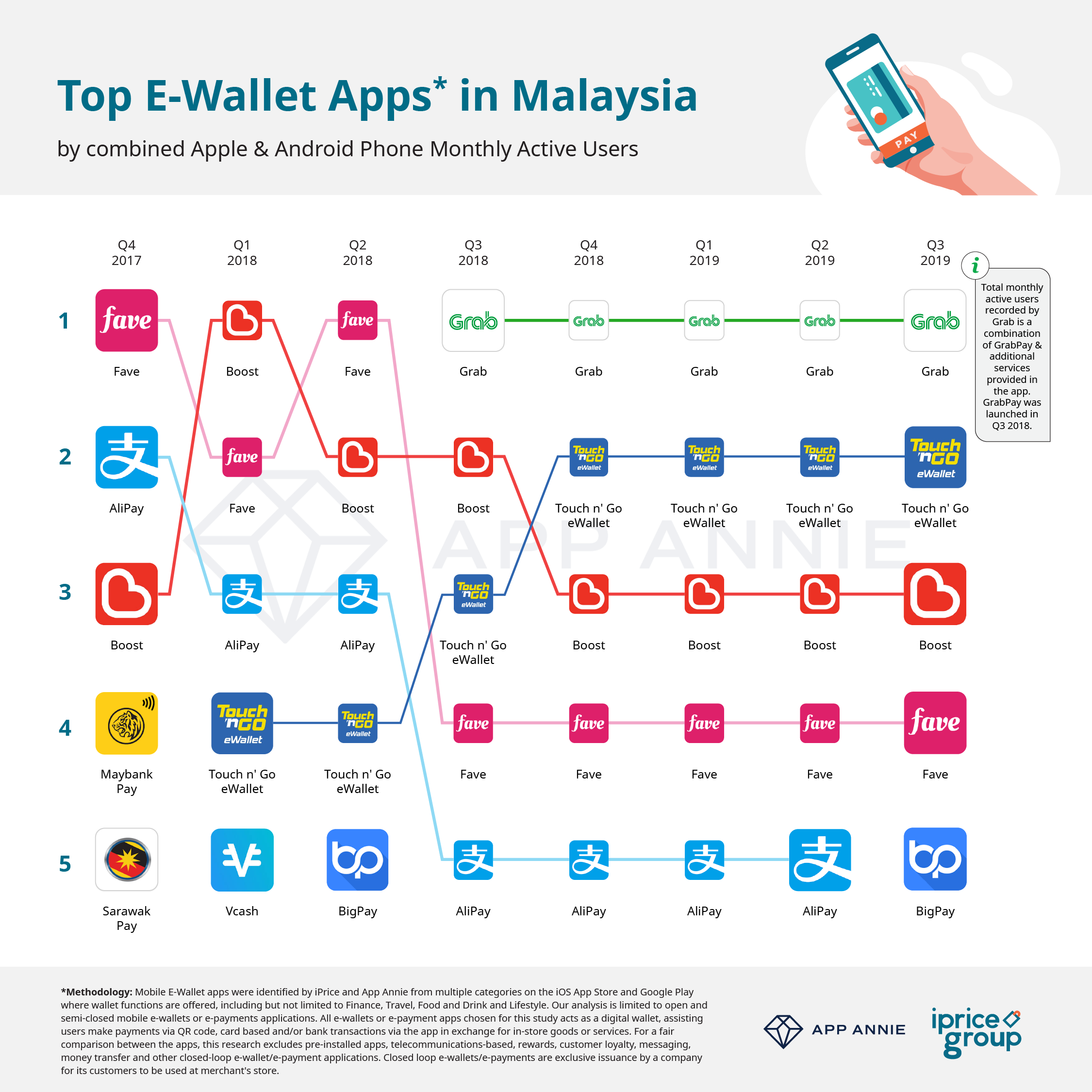

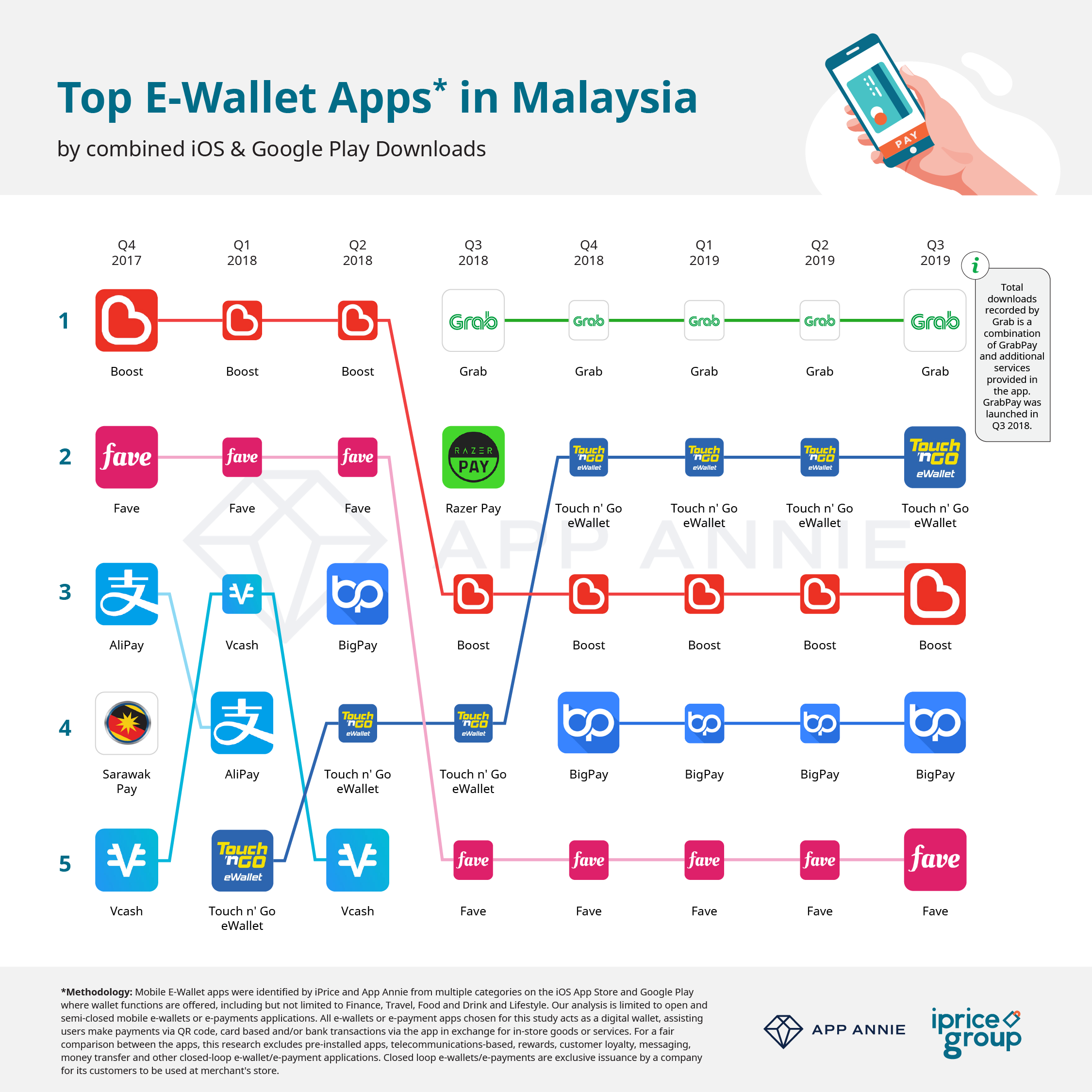

To give you a better understanding of the eWallet scene in Malaysia, the folks over at iPrice, in partnership with App Annie, have published a report that ranks the eWallets in Malaysia. The numbers measured are based on the monthly active users and app downloads at different periods from the end of 2017 till Q3 of 2019, and make for some interesting viewing.

Let’s take a look:

Based on their findings, Grab ranks at number 1 for combined iOS and Android monthly users as of Q3 of 2019, having held onto that position over the course of the year. However, a caveat to that is that Grab is an all-in-one app that is much more than just an eWallet—you’re looking at delivery services, e-hailing, and food delivery—so that might affect the number of users to a degree.

It’s also worth noting that Grab was unable to reveal their exact number of active users overall, although it was reported that 1 in 5 GrabPay users use the Grab app daily. Meanwhile, Grab also tops the chart where it comes to the number of app downloads in Malaysia, over the same period of time.

Meanwhile, a familiar, but relatively new name in the eWallet scene is steadily rising through the ranks. Touch n’ Go eWallet comes in at 2nd for both its active monthly user count and app downloads throughout 2019, which marks an impressive growth from 2018. The app reportedly has 5 million users and over 100,000 merchants registered.

Axiata-backed Boost, who currently has 4.8 million users and almost 115,000 merchants on its platform, continues to rank amongst the top digital payment options in Malaysia. According to the study, they have the 3rd most active monthly users and app downloads over the whole of 2019, with a consistent performance stretching back to 2017.

We’re also seeing strong showings from Fave and BigPay, although it’s notable that BigPay dropped out of the top 5 spots for monthly active users for a period, before coming in at 5th for monthly active users. However, they’ve maintained a solid performance for app downloads over 2019 at 4th. That’s perhaps due to the nature and strengths of BigPay’s app—arguably, the ease-of-use and competitive exchange rates when using the app whilst travelling, which may encourage more intermittent use.

It certainly looks like the eWallet scene in Malaysia is continuing to burgeon, and the options are growing in versatility and function. Now, with governmental support, as shown with the budget allocations announced recently, that trend would appear to be continuing.

If you’d like to read the full report, click here.

Editor’s note: Boost has reached out to us with their latest figures for number of users and merchants. The article above has been amended accordingly.