To me, cashless is the way forward. Having to queue up at ATMs to draw cash just so you can pay for stuff seems so archaic to me. Add that to the fact that you have to carry around fat wallets just so you have space for the paper money and you’re looking at a system that I feel should be eradicated as soon as possible. However, at least as far as Malaysia is concerned, there really isn’t a proper cashless solution, at least not one that’s as universal as something like WeChat Pay or Alipay in China.

Still, there is hope. As more and more companies venture into this space, new ideas are popping up pretty frequently. Today, it’s Digi‘s turn with their brand new mobile payment service vcash.

What vcash it and is it easy to use?

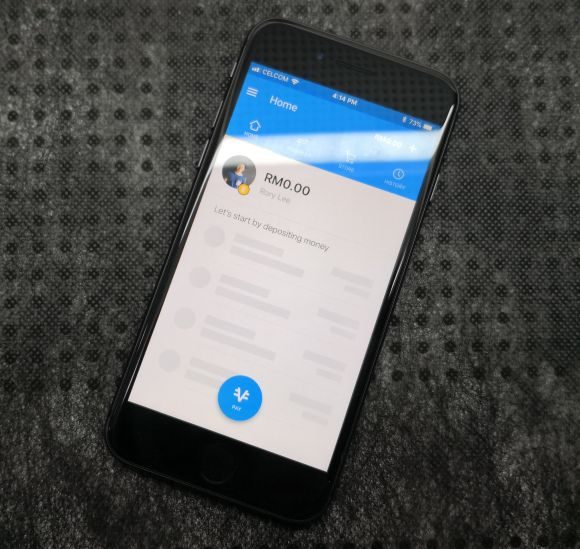

In a nutshell, vcash is a mobile wallet. The idea is, you download the vcash app (iOS and Android), top up some money, and then pay for goods or services that support this service. Kind of like, Touch N Go — and their cashless payment solution — but also not really.

vcash is similar in the sense that you will have to deposit money into your mobile wallet before you can make payments. You also pay by scanning QR codes and authenticating your transactions. However, the way it is implemented is slightly different, and in my opinion, much more convenient.

You see, one of the keywords there is, that you deposit money into your vcash account. This means, you can still “withdraw” that cash and have them transferred to your Maybank account or walk into a Digi store and receive it as cash instead (RM1.06 service charge). Meanwhile, for the Touch N Go Wallet, there was no indication that you could do such a thing. It’s also pretty easy to deposit cash into your vcash wallet because you can do so in over 300 Digi Stores and dealerships nationwide or through the 21 supported internet banking platforms.

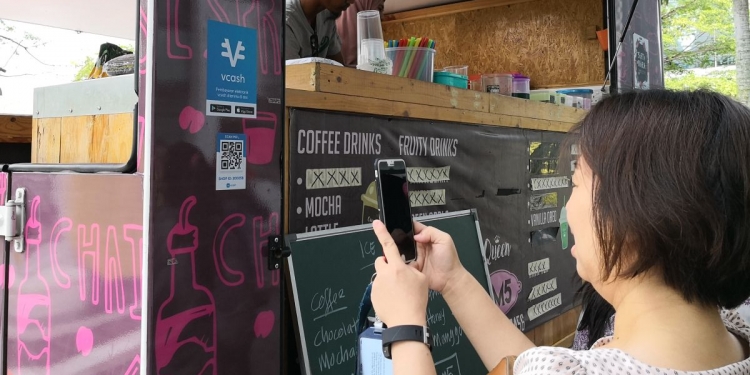

The second key difference is that when you make a payment, YOU scan the QR code, enter the amount and authenticate — not the other way around where the Touch N Go Wallet requires you to generate a QR code that the merchant then has to scan. When they demo-ed it to us at the launch event, the whole process seemed pretty painless. Further, Digi says that you can also authenticate transactions with your phone’s fingerprint scanner (or your face if you’re on iPhone X) if you don’t want to enter a PIN number.

What’s more, vcash says that users won’t be charged a transaction fee for reloading or paying. Digi also says that users can send money to other vcash and non-vcash users using their vcash app. Non-vcash users who get sent money will receive a text message informing them of the transaction and prompting them to download the vcash app so they can get their money.

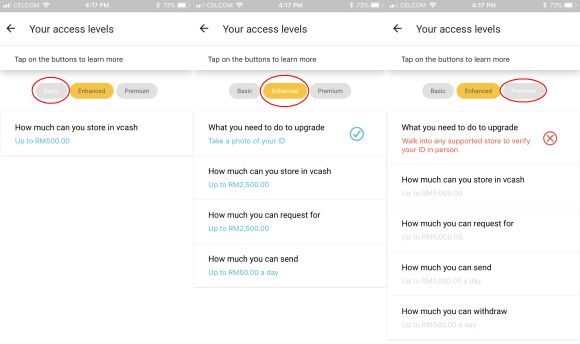

Speaking of the vcash app though, there is a caveat you should know about: There are actually three account tiers that unlock different features in the vcash app — Basic, Enhanced and Premium. The Basic tier will allow users to pay using vcash and keep a mobile wallet of up to RM500. On the Enhanced tier, users will unlock the ability to send up to RM50/day to other vcash and non-vcash users, request up to RM2,500, and expand your wallet limit to RM2,500. Finally, on the Premium tier, your mobile wallet limit gets expanded to RM5,000, you can send up to RM1,000/day, request up to RM5,000, and withdraw up to RM500/day.

The good news is that these tiers aren’t locked behind some paywall. Instead, to gain access to these higher tiers, you will need to provide different levels of ID verification. Basic tier doesn’t require more than your IC/passport number when creating the account. Enhanced tier will require a photo of your IC/passport, while finally the Premium tier will require that you walk into any Digi Store for face-to-face verification.

While I get that it is a little inconvenient to have all these limitations, you should also understand that Digi isn’t a bank so they can’t really act like one. Still, for most daily transactions, I think these limits and are more than sufficient. I should probably also mention that you don’t need to be a Digi subscriber to use vcash, it’s open to everyone. vcash can also be used for online transactions via iPay88 and MOLPay gateways.

Sounds pretty useful but will merchants adopt this?

Ah yes, the biggest hurdle everyone has to overcome when trying to create something universal is always accomplishing mass adoption. No company’s going to want to support a brand new service that nobody uses (yet) especially if it requires a big upfront investment. So how is Digi going to try and get over this hurdle? From what I understand, there are two big reasons they think merchants won’t have a problem implementing this.

The first, there are currently no fees or significant upfront investments to support this technology on the merchant’s side. This means merchants won’t need to spend money on annual fees, installation fees, or invest a bunch of cash on new high-tech machinery. Since it’s a QR code payment system, all they need is to get their own unique QR code which they can obtain when they register online. Theoretically, this makes it easy for anyone to adopt — even small mom-and-pop businesses.

Second, is that the merchant fee for payments involving vcash is currently just 0.8%. That means for every transaction, Digi will take a 0.8% cut of that transaction.

What’s more, Digi’s priding themselves on removing the hassle associated with cash transactions for the merchant. With vcash, merchants can track transactions in real-time so they know when a transaction goes through, and they can also cash out and have the funds transferred directly to their bank accounts in just 1-2 business days.

It’s not perfect, but it’s looks like a step in the right direction

I don’t think I’m alone when I say that needing to deposit cash into an e-wallet is more inconvenient than having a system that can directly charge your bank account. However, as Digi stresses, they are not a bank and for now, those channels to directly access your bank account are still closed.

With that said, vcash does seem like one of the more practical implementations of mobile payments — and it’s certainly more practical than what we saw out of Touch N Go. But vcash isn’t alone here. There are similar alternatives like Boost and FavePay — each of which have their own strengths and weaknesses. It’ll be interesting to see which one proves to be the more successful formula.

What do you guys think? Do you use a mobile payment solution? Let me know in the comments below.

For more info, you can check out their website.